Helping Business Do Business

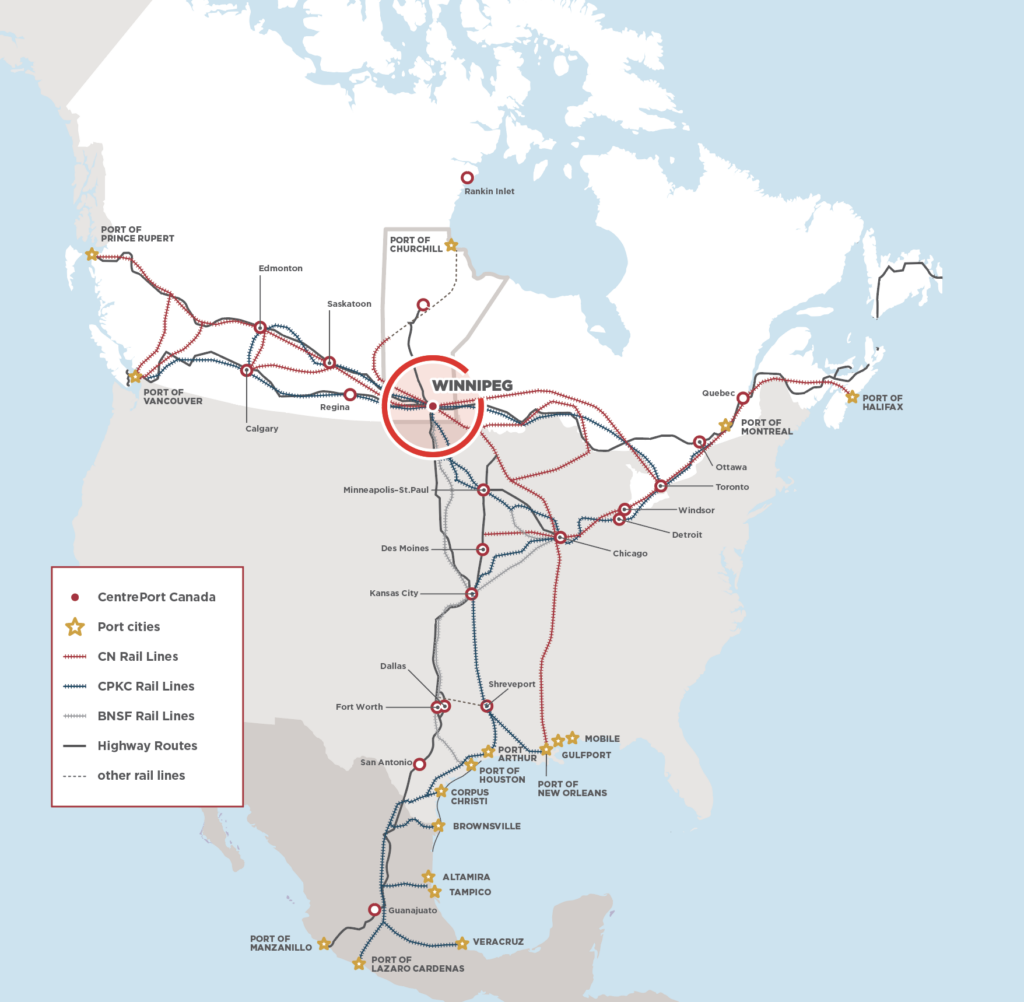

Interested in exploring development at North America’s largest trimodal inland port? Let CentrePort Canada Inc. help you navigate the process and connect you to our extensive network of local decision makers, government contacts and experienced real estate partners.

We offer a wide-variety of single-window services for investors including assistance with incentives and Foreign Trade Zone benefits; land-development approvals; land and space inventory; business, government and market connections; and, industry-related referrals.

REAL ESTATE

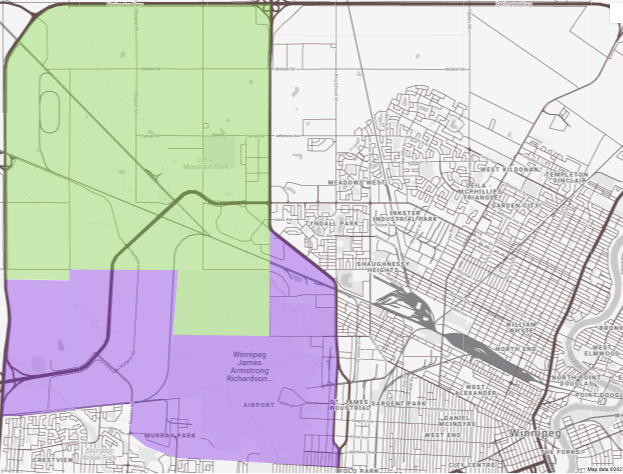

With greenfield, existing or build-to-suit options, prime industrial land is now available for any size of development. With over 2,000 acres currently in active development, CentrePort Canada is a hive of industrial activity in the Winnipeg metropolitan region.

Industrial Parks

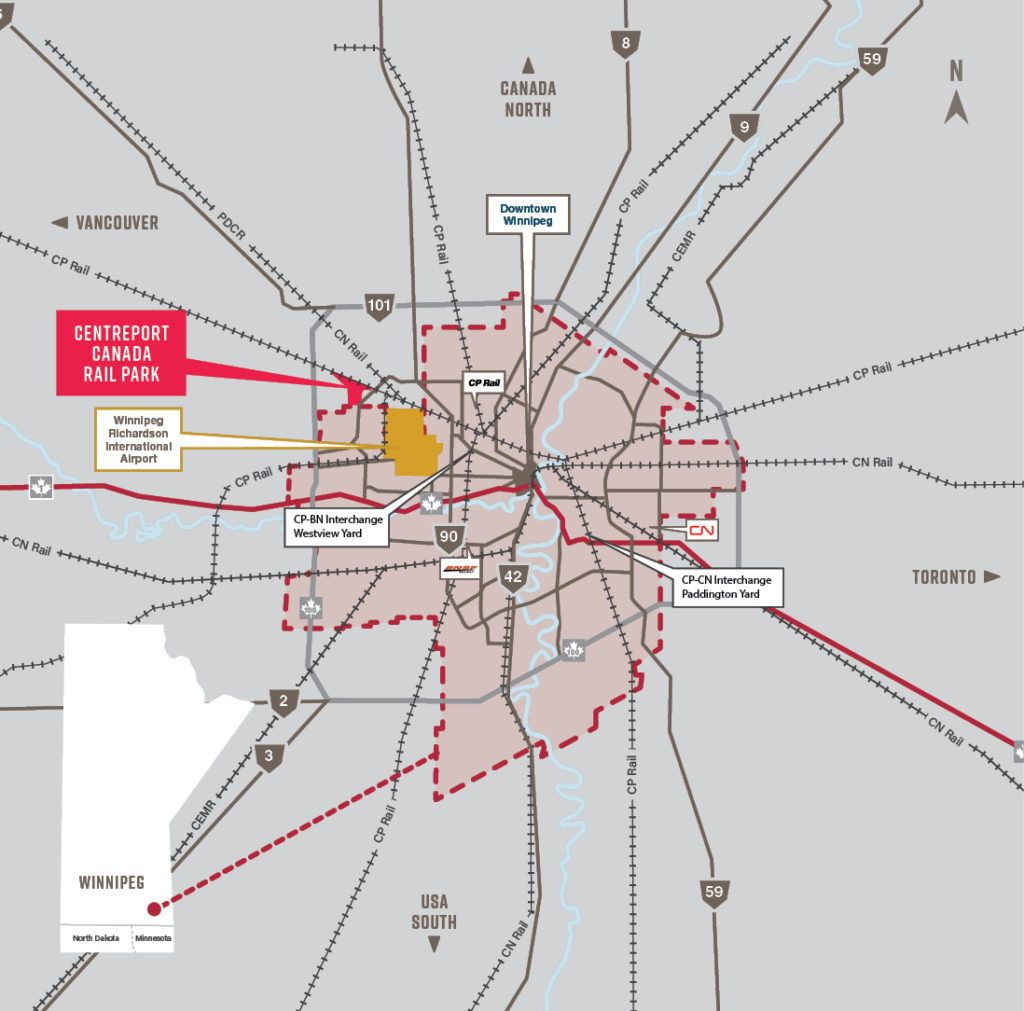

CENTREPORT CANADA RAIL PARK www.centreportcanadarailpark.com

The Rail Park at CentrePort is a 665 acre development that combines industrial space with logistics infrastructure to make it a prime location for companies serving regional and global clients.

- Fully serviced lots from 6.9 to 46.5+ acres

- Lots can be combined

- Developer will consider build-to-suit projects

- Strategically located in the R.M. of Rosser, adjacent to the City of Winnipeg

- Located south of the Canadian Pacific Carberry sub (CPKC’s main east-west line across Canada)

- Within the federal interswitching zones for access to three Class 1 rail carriers from the site

- Access to interstate-quality highways on both east and west sides of the Park, allowing for 5 mins to 90 km/55 mph

- Increased efficiency with the intersection of trimodal transportation, allowing goods to move seamlessly between rail, truck and air cargo

The CentrePort Canada Rail Park development is being led by Focus Equities Inc. Founded over 50 years ago by Canadian entrepreneur Kenneth W. Mariash Sr., Focus Equities Inc. and its associated companies have developed, purchased, or sold more than 15 million square feet of real estate and more than 10,000 residential/condominium units in North America. Focus Equities is currently developing over $5 billion USD of projects in North America and has a long track record of successful, innovative, financial structures. To learn more about Focus Equities Inc., visit www.focusequities.com and to hear more about Ken Mariash’s vision for the CentrePort Canada Rail Park, check out this video.

View the CentrePort Canda Rail Park brochure here.

Maps & Assets

For more information on the CentrePort Canada Rail Park, please contact:

Chris Reiter

Project Manager

Focus Equities Inc.

T 250.388.9924

C 250.920.6768

creiter@centreportrailpark.com

Sonya Muraro

Executive Director, Business Development

CentrePort Canada Inc.

C 204.806.0036

smuraro@centreport.ca

SPECIAL PLANNING AREA

Companies building projects in CentrePort North, RM of Rosser lands within CentrePort Canada, have unique access to a dedicated resource, the Inland Port Special Planning Area. This special planning area expedites the planning and land-development approval process, enabling companies to move through the subdivision and rezoning applications concurrently. This unique approach helps ensure speed to market, gives businesses cost and planning certainty, and provides the community with an accountable and transparent process.

For more information on the Inland Port Special Planning Area visit: gov.mb.ca/mr/centreport/

Resources & Information

FOREIGN TRADE ZONE

Companies located at CentrePort Canada can take advantage of single-window access to Canada’s Foreign Trade Zone (FTZ) programs. The FTZ program that is most often utilized at CentrePort is Canada Border Service Agency’s Customs Bonded Warehouse program, which allows for the deferral of all import levies until goods enter the Canadian economy or are exported.

To learn more about the Government of Canada FTZ programs, visit:

canada.ca/en/department-finance/programs/international-trade-finance-policy/

MANITOBA’S STRATEGIC ADVANTAGES

Come see how the centre of the continent is becoming the centre of attention for so many international companies. Winnipeg’s key sectors – aerospace, advanced manufacturing, creative industries, ICT and agribusiness – continue to grow at a safe, reliable rate, making Winnipeg a great choice to grow your business.

Manitoba is a great place for business investment and a great place to run a business.

- Low Business Costs

- Supportive Business Community

- Skilled & Productive Workforce

- Transportation & Location Advantages

- Competitive R&D Environment

- Low-cost, Clean & Reliable Hydro Energy

- Affordable & Attractive Four-Season Lifestyle

For a comprehensive overview of key sectors, site selection data and competitive advantages visit: economicdevelopmentwinnipeg.ecdev.org

845,000

POPULATION (CMA)

1 hour

Proximity of Winnipeg to the U.S. border

99.6%

Energy that comes from

renewable sources (Manitoba)

PARTNER WITH US

Through the CentrePort Canada Partnership Program, CentrePort works closely with a group of reputable, professional, Manitoba-based organizations who support local businesses within the inland port and across Canada. Let us connect your company to local decision makers.